Understanding the Complexities of Section 351 Exchange

A 351 exchange, under Section 351 of the Internal Revenue Code, allows for tax-free transfers of assets into an investment company, such as an ETF. While this structure offers significant tax advantages, navigating a 351 conversion requires careful planning to avoid common pitfalls. Key Challenges in a 351 Exchange Diversification Requirements: To qualify as a […]

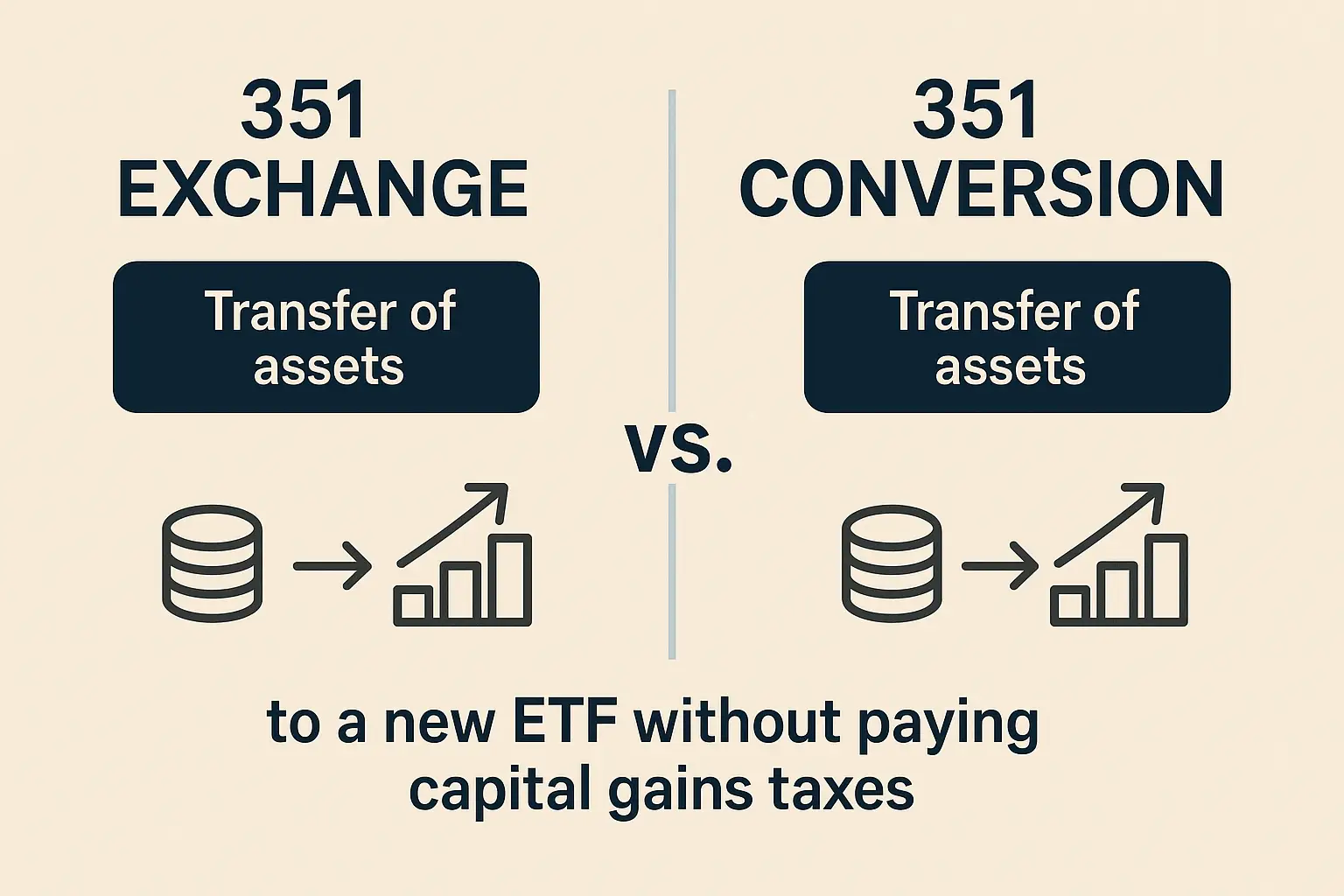

351 Exchange vs. 351 Conversion: Which Term is Correct?

When discussing the strategic move of investment portfolios, such as Separately Managed Accounts (SMAs), into the efficient structure of an Exchange Traded Fund (ETF) without triggering immediate tax liabilities, you’ll often encounter two key phrases: 351 exchange and 351 conversion. You might wonder if these are different processes that commonly get confused like Exchange Fund […]

Got Crypto? Why Direct Contributions to New ETFs Are a Tough Sell

Ever thought about using a nifty IRS Section 351 tax free exchange to contribute your cryptocurrency directly to an exciting, new ETF? It’s an intriguing idea, but today’s financial and regulatory landscape throws up some serious hurdles. Currently, directly transferring spot cryptocurrencies to a new ETF launches through a 351 exchange isn’t an option. Why […]