351 Tax Free Conversion

A 351 tax-free conversion, much like a 1031 exchange for real estate but for public securities, allows investors to transfer appreciated assets, such as stocks or securities, into a newly formed corporation, such as an ETF, without incurring immediate taxable events.

Process Of 351 Tax Free Conversion

A 351 tax-free conversion, much like a 1031 exchange for real estate but for public securities, allows investors to transfer appreciated assets, such as stocks or securities, into a newly formed corporation, such as an ETF, without incurring immediate taxable events.

The newly formed entity inherits the cost basis and holding period of the transferred assets, preserving their tax characteristics. This process, often referred to as a “351 exchange,” allows investors to restructure portfolios without triggering immediate tax liabilities.

This mechanism is made possible by Section 351 of the U.S. Internal Revenue Code. For the transaction to be considered tax-free, certain conditions must be met, such as diversification compliance, where no single asset exceeds 25% of the portfolio, and control requirements, where original contributors retain at least 80% control of the ETF’s voting power and value post-conversion. Accurate record-keeping of the cost basis and holding periods for all contributed assets is also crucial for tax reporting purposes.

What Can Be Contributed?

Numerous nontax and tax advantages exist for utilizing an ETF structure, including transparency, liquidity, ease of trading, low cost, scalability, access to complex investments, a larger universe of possible investors, and tax-deductible advisory fees. A 351 tax-free conversion involves the tax-deferred transfer of appreciated assets into a newly formed corporation.

Several types of assets can be contributed in a 351 exchange:

US equities and ADRs

US equities and ADRs, as long as they are liquid and align with the fund strategy

Foreign equities and GDRs

are eligible, provided the market allows for in-kind transfers.

US and foreign ETFs

US and foreign ETFs are allowed. The underlying assets within the ETF are subject to diversification rules, and foreign ETFs must be redeemable in-kind.

Closed-end funds

Closed-end funds are eligible if publicly traded and redeemable in-kind.

Fixed income ETFs

Fixed income ETFs are acceptable if aligned with the broader strategy, but a large portion used to launch an all-equity ETF would not be suitable.

Spot crypto within an ETF

Spot crypto within an ETF (like GBTC) is eligible if aligned with the fund strategy, but spot crypto cannot be held directly.

Commodity ETFs

Commodity ETFs (like GLD) are eligible in small portions if aligned with the fund strategy.

MLPs/Public Partnerships

MLPs/Public Partnerships are acceptable in small amounts if aligned with the fund strategy.

What CANNOT Be Contributed?

In addition to asset types, several other factors influence eligibility for a 351 exchange:

Several types of assets CANNOT be contributed in a 351 exchange:

Mutual funds

Mutual funds cannot be traded in-kind, rendering them unsuitable for a 351 transaction.

Private stocks/REITs

Private stocks/REITs and restricted stock units lack the required in-kind redeemability.

Hedge funds

Hedge funds, while potentially eligible, require a complete transfer of assets, alignment with the prospectus, and the unwinding of derivatives exposure and leverage.

Cash

Cash, although often part of a portfolio, is not considered in diversification calculations. For example, a portfolio containing 50% Nvidia stock and 50% cash does not meet the diversification requirement.

Diversification Rules

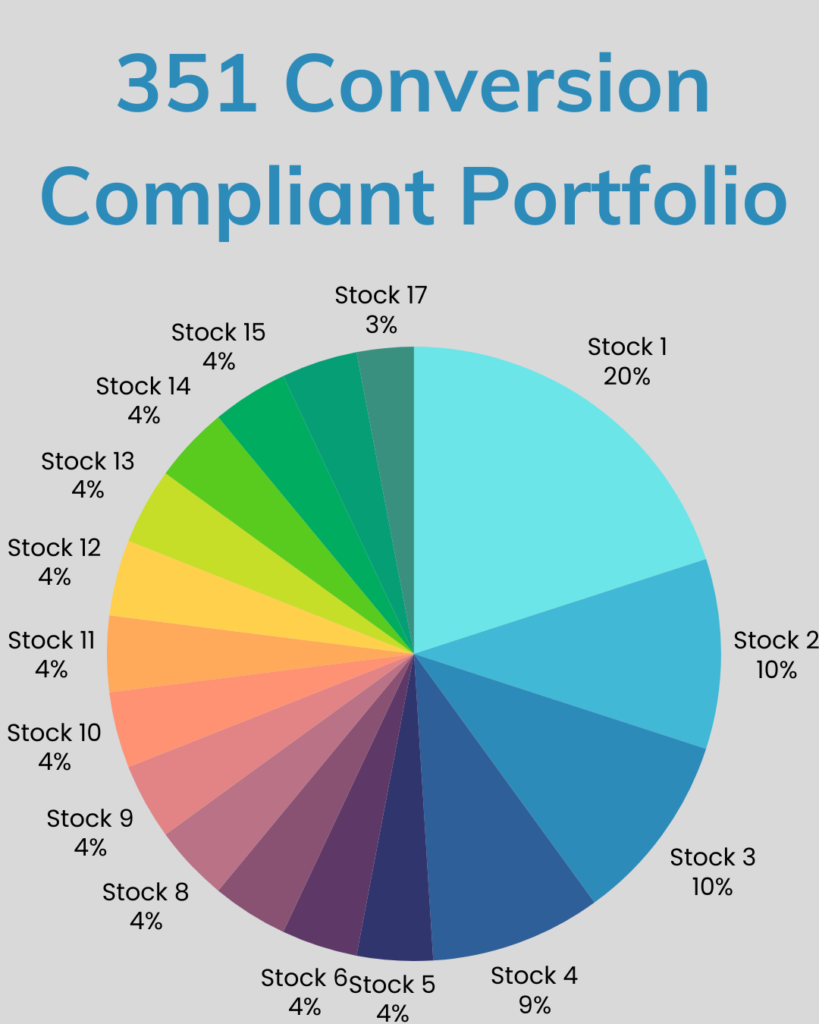

These assets must be diversified to meet IRS standards, meaning no single asset can exceed 25% of the total portfolio value and assets exceeding 5% collectively must remain under 50%.

Failing to comply with these diversification requirements could result in a taxable event for the investor. It’s important to remember that a 351 conversion is a “one-time” contribution and investors can’t make tax-free contributions into the newly formed ETF after the conversion. Therefore, it is crucial to plan and ensure that the portfolio is sufficiently diversified before the conversion.

Look-Through Treatment for ETFs: When a transferor holds stock in an ETF, the underlying holdings of that ETF are considered for diversification purposes. For example, if an SMA includes 10% in SPY, the underlying holdings of SPY are combined with the rest of the portfolio for the 25% and 50% tests. Cash and Government Bonds within the ETF are excluded for diversification purposes

Learn More About Rules & Regulations

List of Resources

The case for the tax-free conversion of SMAs into an ETF via Section 351

Investors and advisors need to understand why converting separately managed accounts (“SMAs”) assets into an ETF via a 351 tax-free conversion might make sense. As partner and co-founder of the law firm Practus, LLP, which primarily focuses on investment funds and technology companies, I have been the quarterback for more than 40 Section 351 transfers to ETFs and mutual funds. My partners and I have helped Wes and his team at ETF Architect with multiple mutual fund, LP, and SMA 351 conversions. With that breadth of experience, we have encountered almost every quirk imaginable regarding 351 transactions.

Sound of ETFs: The Insider's Guide to 351 Exchanges for ETFs

Are you familiar with 351 exchanges? Learn how this powerful tool can help you transition your SMA to an ETF efficiently and tax-effectively in this first article of the new "Sound of ETFs" educational series on ETF Central.

Understanding 351 Conversions

For investors and financial advisors managing Separately Managed Accounts (SMAs) with significant unrealized gains, the challenge is clear: how to unlock liquidity and restructure portfolios without triggering tax liabilities. Section 351 of the U.S. Internal Revenue Code provides a potential solution, a tax-deferred conversion of SMA holdings into an Exchange-Traded Fund (ETF). This strategy may defer capital gains but also offers potential operational and structural benefits of ETFs.

Get On Our List

Fill Out One Of Our Forms

Please select the right page and fill out one of our easy contact forms. We reach out to you when we have a match.

ETF Issuers

If you are an ETF Issuer with plans to launch a new ETF and would like to gather assets via a 351 tax free conversion click here to get connected with investors that would like to participate.

Investors

If you are an individual investor and would like to learn how you can diversify out of your appreciated stock positions without paying capital gains tax while participating in a new ETF issue, click below.

Wealth Managers

If you manage Separately Managed Account or act as a wealth advisor, click below to learn how you can diversify your clients holdings while not paying any capital gains tax.

Don't Hesitate to Invest Now, We Will Give You The Best!

Please reach out. If you are a ETF issuers and would like to get matched up with investors looking for your products, or if you are an investor that would like to know about upcoming ETF launches.